Nintendo Earnings

Missed Expectations and Market Reactions

Nintendo’s recent earnings have sparked significant discussion in both the gaming and investment communities. The company’s share price plummeted over 15% this Monday, contributing to the Nikkei index experiencing its largest drop since 1987. This decline also affected other Japanese gaming companies, including Capcom and Sega.

A Snapshot of Nintendo's Fiscal Q1 Performance

Nintendo’s first fiscal quarter revealed notable year-on-year declines in both revenue and profit.

-

Net sales: 246.6 billion yen, falling short of the consensus estimate of 289.6 billion yen.

-

Net Profit: 80.9 billion yen, surpassing the expected 70.7 billion yen.

Despite the higher-than-expected net profit, Nintendo experienced substantial year-on-year declines in net sales (down 46.5%) and net profit (down 55.3%). This decline is largely attributed to the aging Nintendo Switch console, with sales dropping 46% year-on-year to 2.1 million units.

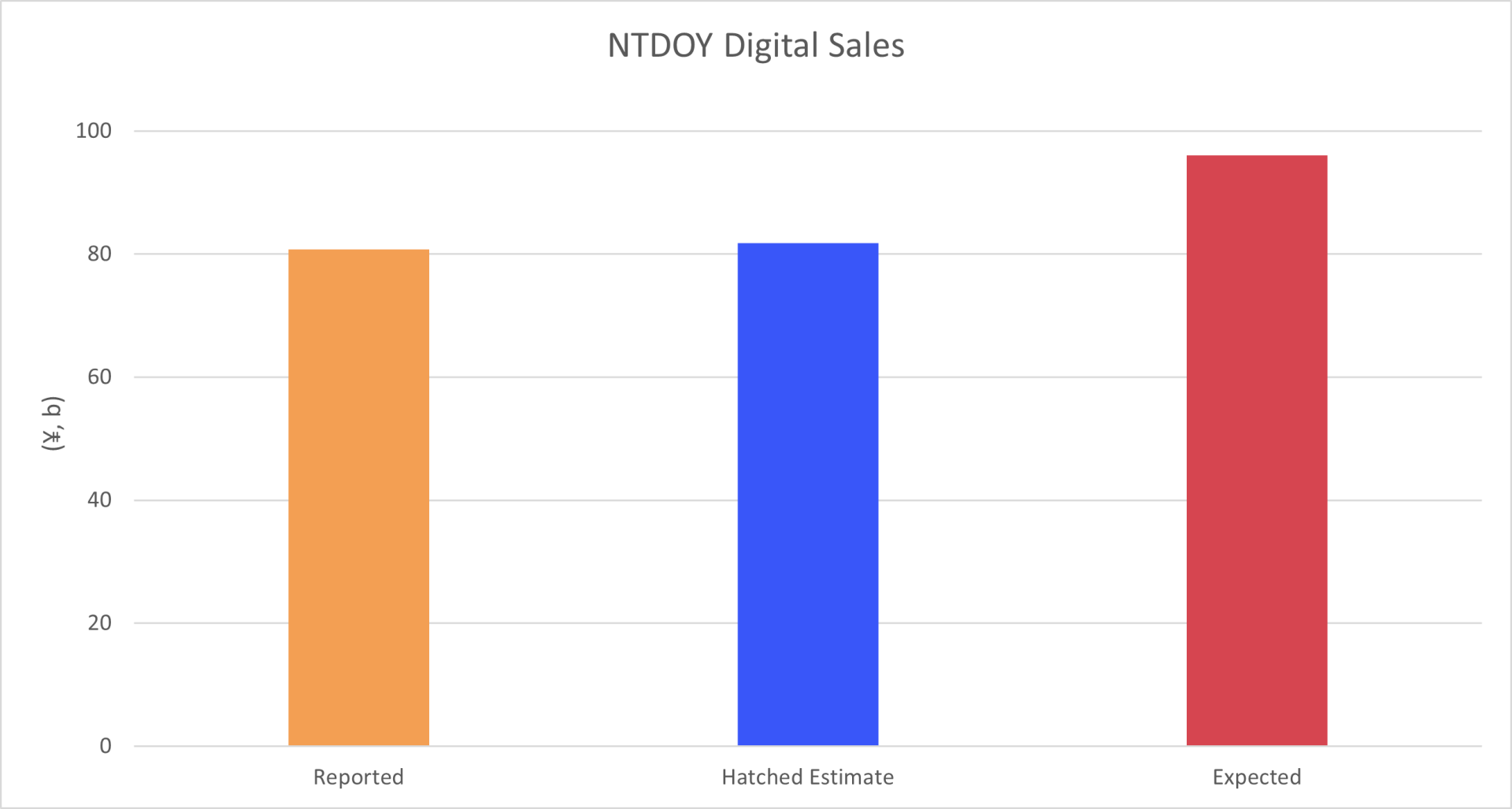

Additionally, digital sales were down 32.5% compared to last year, at 80.7 billion yen versus an expected 96 billion. Hatched Analytics predicted 81.8 billion yen in digital sales for this quarter.

Why Traditional Predictions Faltered

The significant miss by consensus analysts raises important questions about the reliability of traditional forecasting methods in the rapidly evolving gaming industry. Several factors likely contributed to this miscalculation:

-

Overestimation of Hardware Sales: Consensus analysts likely overestimated the continued demand for the aging Switch console. While the Switch has been immensely successful, it is now over seven years old, and consumers are eagerly awaiting news of a successor.

-

Lack of Blockbuster Releases: Nintendo did not launch any major new games early enough in the quarter to significantly impact sales. While titles like Paper Mario: The Thousand-Year Door and Luigi’s Mansion 2 HD were released in May and June, they did not have sufficient time or possibly the necessary impact to positively influence the overall quarterly results.

-

External Market Conditions: Analysts also point to broader economic factors as contributing to the instability. Fears of a potential US recession and rising geopolitical tensions in the Middle East have further impacted market stability.

In contrast, our alternative data report demonstrated remarkable accuracy in predicting Nintendo’s digital sales. We utilize proprietary data and continuously update our reports based on new information, allowing for more responsive and accurate forecasting.

Looking Ahead

Investors will be closely watching for any announcements regarding the successor to the Switch, which is expected to launch before the end of March 2025. In the meantime, Nintendo’s strategy to navigate the challenges of an aging console includes sustaining interest in the Switch through new game releases and more licensing deals.

While consensus predictions stumbled, our ability to predict digital sales with such a low error rate has proven invaluable, offering a more accurate and nuanced understanding of Nintendo’s performance. Learn more about our NTDOY/7974.T report here or schedule a demo with our team.